Home Insurance: Protecting Your Property and Belongings

Published on August 12, 2024

Home insurance is a critical safeguard for homeowners, offering protection against financial loss due to damage or theft of your property and belongings. With various coverage options available, it's essential to understand what home insurance includes and how it can benefit you.

The main types of home insurance coverage are dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Dwelling coverage protects the structure of your home from risks such as fire, wind, or vandalism. Personal property coverage safeguards your belongings, including furniture, electronics, and clothing, from similar perils.

Understanding Coverage Details

Liability coverage provides financial protection if you are found responsible for injuries or property damage to others. This can include medical expenses, legal fees, or repair costs. Additional living expenses coverage helps with the cost of temporary housing and living expenses if your home becomes uninhabitable due to a covered loss.

It's important to review the coverage limits and exclusions of your policy to ensure adequate protection. Some policies may not cover certain risks, such as flooding or earthquakes, so you may need to purchase additional coverage for these perils.

Choosing the Right Policy

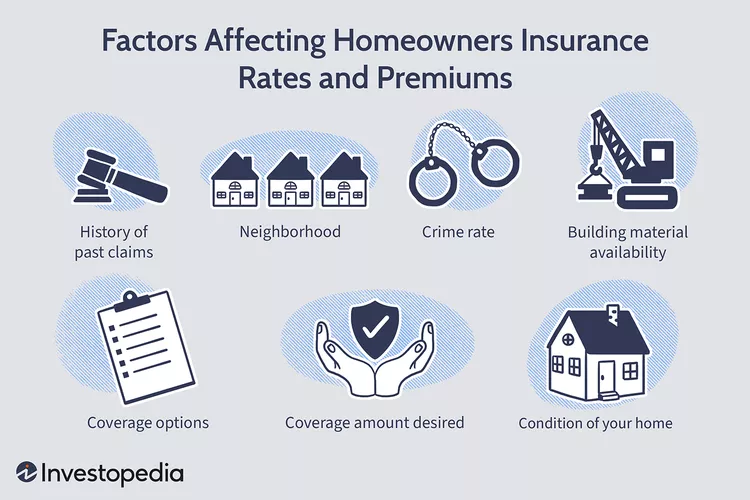

When selecting a home insurance policy, consider factors such as the value of your home and belongings, the location of your property, and your budget. Higher coverage limits and lower deductibles may offer better protection but could result in higher premiums. Evaluating your needs and comparing policies can help you find the best balance between coverage and cost.

Additionally, exploring discounts for home security systems, bundling policies, or maintaining a claims-free history can help reduce your premium. Regularly reviewing your policy and updating it as needed ensures you have adequate protection for your home and belongings.

Conclusion

Home insurance is essential for protecting your property and personal belongings from unexpected events. By understanding the coverage options and selecting a policy that fits your needs, you can safeguard your home and financial well-being against potential losses.