Understanding Homeowners Insurance

Published on August 12, 2024

Homeowners insurance is a vital form of protection that every homeowner should have. It provides coverage for your home and personal belongings in the event of damage or loss due to covered perils, such as fire, theft, or natural disasters. Additionally, it offers liability protection in case someone is injured on your property.

A standard homeowners insurance policy typically includes several key types of coverage: dwelling coverage, personal property coverage, liability coverage, and additional living expenses coverage. Understanding what each of these covers can help you ensure that you have adequate protection for your home.

Dwelling Coverage

Dwelling coverage protects the structure of your home, including the roof, walls, and foundation. It covers repairs or rebuilding costs if your home is damaged by a covered peril, such as fire, windstorm, or vandalism. It's important to ensure that your dwelling coverage limits are high enough to cover the full cost of rebuilding your home in the event of a total loss.

Personal Property Coverage

Personal property coverage protects your belongings, such as furniture, clothing, and electronics, from damage or theft. This coverage typically extends to items both inside and outside your home, including those in storage or temporarily away from your property. It's advisable to take an inventory of your personal belongings to ensure that your coverage limits are sufficient.

Liability Coverage

Liability coverage provides financial protection if you are found legally responsible for causing injury to others or damage to their property. This can include incidents that occur on your property, such as someone slipping and falling, as well as those that happen away from home. Liability coverage helps cover legal fees, medical expenses, and any damages awarded by a court.

Additional Living Expenses Coverage

If your home becomes uninhabitable due to a covered peril, additional living expenses (ALE) coverage can help pay for temporary housing and other necessary expenses while your home is being repaired or rebuilt. This coverage ensures that you and your family can maintain your standard of living during a difficult time.

Why Homeowners Insurance Is Essential

Homeowners insurance is crucial because it provides financial protection against unforeseen events that could result in significant losses. Without this coverage, you would be responsible for the full cost of repairs, replacement of personal belongings, and legal liabilities. Additionally, most mortgage lenders require homeowners insurance as a condition of the loan, making it a necessity for anyone purchasing a home.

Choosing the Right Policy

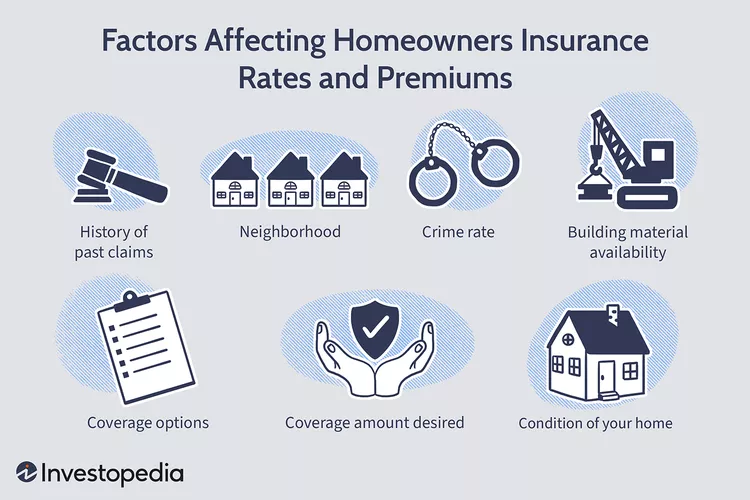

When selecting a homeowners insurance policy, it's important to consider the value of your home, the replacement cost of your belongings, and your risk tolerance. You should also review the policy's exclusions and limitations to ensure that it meets your needs. Shopping around and comparing quotes from different insurers can help you find the best coverage at a competitive price.

Conclusion

Homeowners insurance is an essential safeguard for your home and personal belongings. By understanding the different types of coverage and selecting a policy that fits your needs, you can protect your property and financial well-being from unexpected events.