Life Insurance Types: Whole vs. Term Insurance

Published on August 12, 2024

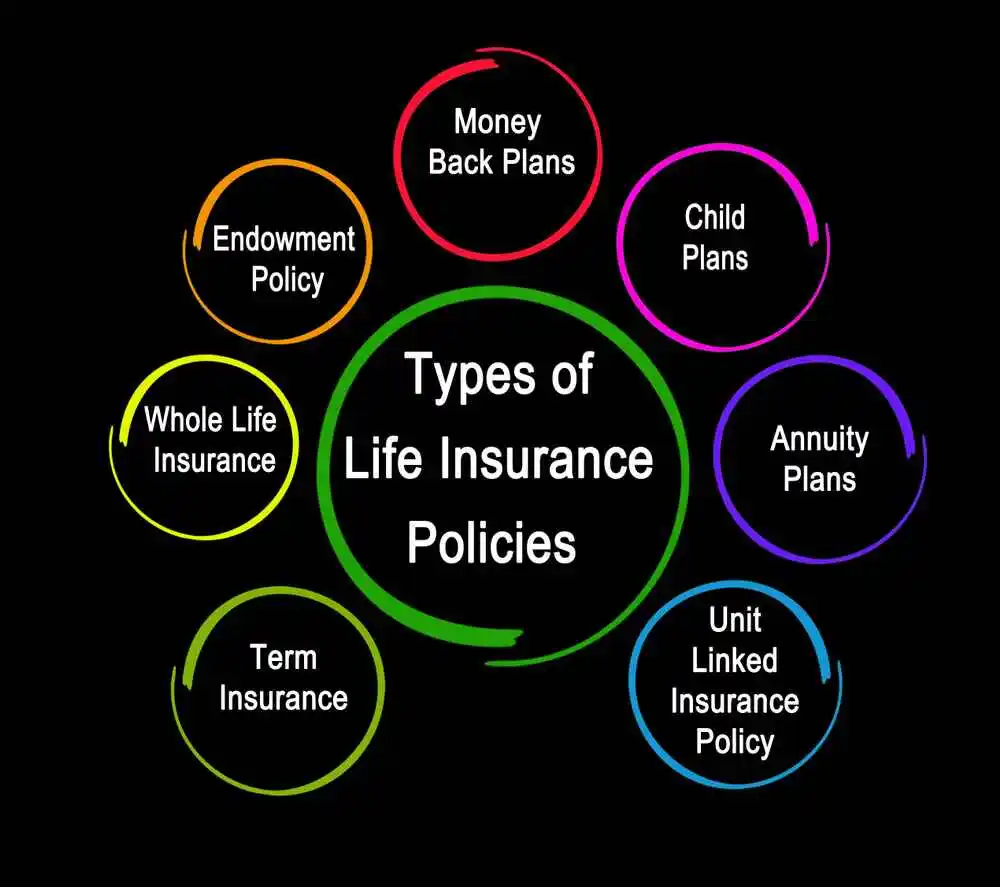

Choosing the right type of life insurance policy is crucial for ensuring that your financial goals and needs are met. Two of the most common types of life insurance are whole life insurance and term life insurance. Each offers distinct benefits and features that can impact your financial planning.

Whole life insurance provides lifelong coverage and includes a savings component known as cash value. This cash value accumulates over time and can be accessed through policy loans or withdrawals. Whole life insurance premiums are generally higher than those for term life insurance, but the policy offers guaranteed coverage for the insured's entire life.

Understanding Whole Life Insurance

Whole life insurance is designed to offer both insurance protection and an investment component. The policy builds cash value at a guaranteed rate, which can be used to cover expenses or serve as an investment. Additionally, whole life insurance policies often offer dividends, which can be reinvested or used to reduce premiums.

The main advantages of whole life insurance include the predictability of premiums and the guaranteed death benefit. However, the higher cost of premiums may not be feasible for everyone, especially if the primary goal is to provide temporary coverage.

Understanding Term Life Insurance

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. If the insured passes away during the term, the death benefit is paid out to the beneficiaries. Term life insurance does not build cash value and typically has lower premiums compared to whole life insurance.

Term life insurance is ideal for those seeking affordable coverage for a set period, such as while raising children or paying off a mortgage. It offers flexibility in terms of policy length and coverage amounts but does not provide lifelong protection or cash value accumulation.

Choosing the Right Policy

When deciding between whole life and term life insurance, consider your financial goals, coverage needs, and budget. Whole life insurance may be suitable for those looking for lifelong coverage and a savings component, while term life insurance is often preferred for its affordability and flexibility.

Assess your long-term financial needs and objectives to determine which type of policy aligns best with your goals. Consulting with a financial advisor can also help you make an informed decision based on your individual circumstances.

Conclusion

Both whole life and term life insurance offer valuable benefits, and the right choice depends on your personal and financial goals. By understanding the key differences between these types of policies, you can select the insurance that best fits your needs and provides the coverage you require.