The Role of Deductibles in Your Insurance Policy

Published on August 12, 2024

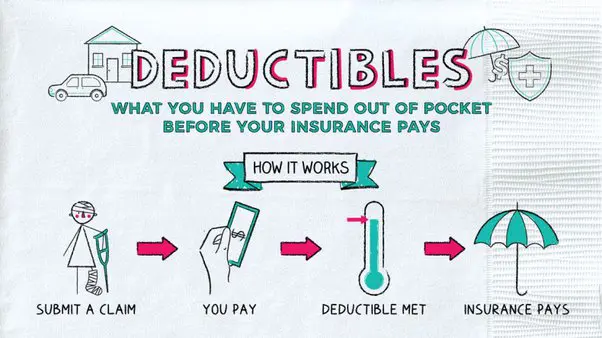

Understanding how deductibles work in your insurance policy is essential for managing your coverage and premiums effectively. A deductible is the amount you are required to pay out-of-pocket before your insurance coverage kicks in. This concept applies to various types of insurance, including health, auto, and home insurance.

The deductible amount can significantly impact your insurance premiums and overall cost. Generally, a higher deductible means lower monthly or annual premiums, while a lower deductible results in higher premiums. Choosing the right deductible amount involves balancing your monthly budget with the potential financial risk you are willing to assume.

Understanding Deductibles

A deductible is a fixed amount specified in your insurance policy that you must pay before the insurer begins to cover the remaining costs. For example, if you have a $1,000 deductible on your health insurance policy and incur $3,000 in medical expenses, you will pay the first $1,000, and the insurer will cover the remaining $2,000.

Deductibles can vary widely depending on the type of insurance and policy. Some policies offer a choice of deductible amounts, allowing you to select a level that fits your financial situation. It's important to review your policy's deductible terms to understand how they affect your coverage and costs.

Impact on Premiums

The deductible amount directly influences your insurance premiums. A higher deductible generally results in lower premiums because you are assuming more of the financial risk. Conversely, a lower deductible means higher premiums as the insurer covers more of the costs upfront.

When selecting a deductible amount, consider your financial capacity to cover the deductible in the event of a claim. While higher deductibles can save you money on premiums, they can also lead to higher out-of-pocket expenses when a claim is made.

Choosing the Right Deductible

To choose the right deductible, assess your budget and risk tolerance. A higher deductible may be appropriate if you have sufficient savings to cover potential claims and prefer lower premiums. On the other hand, a lower deductible might be suitable if you want to minimize out-of-pocket expenses and are willing to pay higher premiums.

It's also important to review your insurance policy periodically and adjust your deductible as needed based on changes in your financial situation or coverage requirements.

Conclusion

Deductibles play a crucial role in determining your insurance costs and coverage. By understanding how deductibles work and their impact on premiums, you can make informed decisions about your insurance policy. Choose a deductible that aligns with your financial goals and risk tolerance to ensure adequate protection and manageable costs.