The Future of Insurance Technology

Technology is revolutionizing industries across the globe, and the insurance sector is no exception. From advanced data analytics to artificial intelligence (AI), technology is reshaping how insurance companies operate and interact with their customers. In this article, we explore the key technological advancements driving change in the insurance industry and what the future holds for insurance technology.

1. Artificial Intelligence and Machine Learning

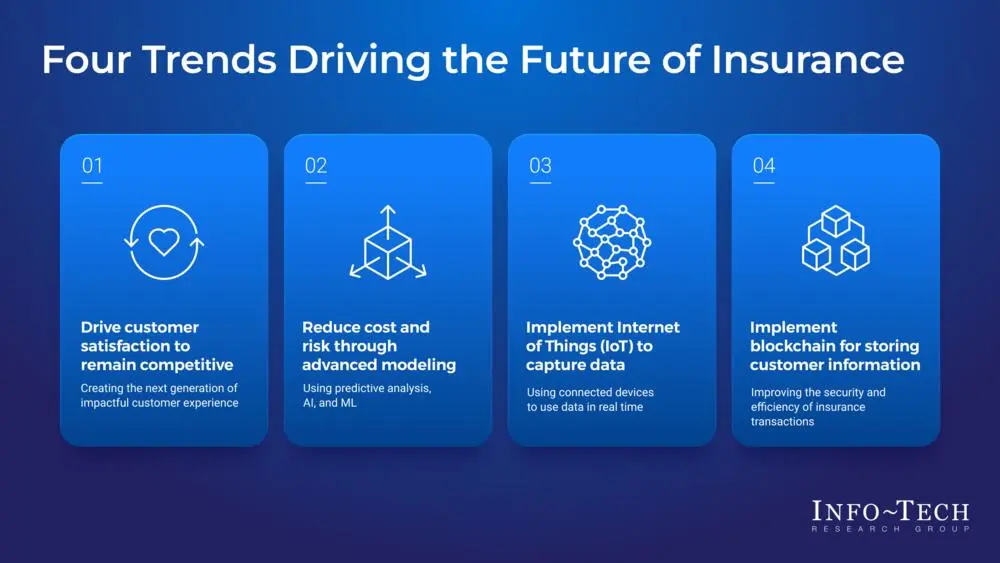

Artificial intelligence (AI) and machine learning are at the forefront of insurance technology. These technologies enable insurers to analyze vast amounts of data to predict risk, detect fraud, and personalize customer experiences. AI-powered chatbots and virtual assistants are becoming common, providing customers with 24/7 support and quick answers to their queries. Machine learning algorithms also enhance underwriting processes by identifying patterns and trends that might not be immediately apparent.

2. Blockchain Technology

Blockchain technology offers a secure and transparent way to record transactions. In the insurance industry, blockchain can streamline processes such as claims management and policy administration. By creating immutable records of transactions, blockchain reduces the risk of fraud and ensures that all parties have access to the same information. This transparency can lead to more efficient and trustworthy interactions between insurers and policyholders.

3. Internet of Things (IoT)

The Internet of Things (IoT) refers to the network of interconnected devices that collect and exchange data. In insurance, IoT devices such as smart home sensors, wearable fitness trackers, and telematics in vehicles provide real-time data that can be used to assess risk and personalize insurance policies. For example, telematics can track driving behavior to offer usage-based insurance premiums, while smart home devices can alert insurers to potential risks and prevent losses.

4. Big Data Analytics

Big data analytics involves analyzing large and complex data sets to uncover insights and trends. Insurers use big data to enhance their risk assessment models, improve customer segmentation, and tailor their marketing strategies. By leveraging data from various sources, including social media, financial records, and customer interactions, insurers can make more informed decisions and deliver more targeted products and services.

5. Digital Transformation and Customer Experience

Digital transformation is reshaping the insurance industry by enhancing customer experiences and streamlining operations. Online platforms and mobile apps enable customers to manage their policies, file claims, and access support from anywhere. Digital tools also facilitate faster and more efficient claims processing, reducing the need for manual paperwork and improving overall customer satisfaction. Insurers are increasingly investing in user-friendly digital interfaces to meet the evolving expectations of tech-savvy consumers.

6. Telemedicine and Virtual Healthcare

Telemedicine and virtual healthcare have gained prominence, especially in light of recent global events. Insurers are integrating telemedicine services into their health insurance offerings, allowing policyholders to consult with healthcare professionals remotely. This integration not only enhances access to care but also helps manage healthcare costs by reducing the need for in-person visits. Virtual healthcare is expected to become a standard feature in health insurance plans, providing greater convenience and support for policyholders.

7. Enhanced Fraud Detection

Technology plays a crucial role in detecting and preventing insurance fraud. Advanced algorithms and data analytics help identify suspicious activities and flag potentially fraudulent claims. By analyzing patterns and anomalies, insurers can more effectively combat fraud and reduce the associated costs. Continuous advancements in technology are expected to improve fraud detection capabilities and protect both insurers and policyholders from fraudulent activities.

Conclusion

The future of insurance technology promises significant advancements that will transform how insurers operate and interact with their customers. From AI and blockchain to IoT and big data, these technologies are driving innovation and creating new opportunities in the insurance industry. As technology continues to evolve, insurers must stay ahead of the curve to deliver enhanced services, improve risk management, and meet the changing needs of their customers. Embracing these technological advancements will be key to navigating the future of insurance.